4/16: Thoughts from the week

-I’m kind of addicted to the Babycenter forums. I discovered them a few months ago, but it’s pretty amazing because you can check out the forums for the month your baby was born:

It’s fun to see how other moms and babies are doing, and read advice and tips. I lurk it a few times everyday 🙂

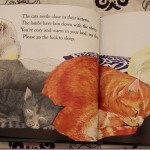

-I told myself that I probably wouldn’t co-sleep with Olivia –I was scared about rolling over onto her- and now it happens pretty much every morning. It feels like more of a half-sleep than anything because I’m aware that she’s there, but it’s so nice to snuggle up and wake up slowly.

Sometimes she’ll fall back asleep for another hour or so- I should have learned how to nurse on my side a lot sooner.

-Another thing I could have done earlier? Worn Livi in the carrier to grocery shop. Emily does this pretty often, but I was usually so worried about the time bomb ticking, I’d put her in the large part of the shopping cart in her carseat, and quickly fill up the the little portion with the few things we needed.

(At Sunflower Market, 8 weeks old)

Today, I put her in the Baby K’Tan

and actually got a full cart of groceries! It’s like I discovered a magical secret 😉

I had visions of leaving our entire basket full of stuff due to an epic meltdown, but she loved walking around and looking at everything.

-Speaking of epic meltdowns, Livi has a new scream. She’s not crying, just testing her lung power, and makes the shrillest, high-pitched “AHHHHHHH!!!!” It’s pretty hilarious.. she sounds like a baby vilociraptor.

-Today, the last of the cloth diaper supplies arrived…..

The Pilot opened it and was like, “what is this stuff for?”

“Cloth diapers”

“You have fun with that.”

He was totally on board initially, but for now, he’s loving the disposables. We’ll see how all of this goes down… I’m going to wash all of the diapers tonight, and probably start tomorrow. Wish me luck 😉

-Even though I’m focusing on being more present, I can’t help but think about certain things in the future. Increasing the deposits to Livi’s college fund is one of the things that comes to mind. Before we knew she was on the way, just that we wanted kids, we started a savings account for our first one and began depositing money into it every month. Sometimes it was only $50, other times we had more to spare, but I’m glad we have something in her name. As far as college goes, they offer quite a few different savings plans (like the 529) but I’m also wondering if Tom’s GI Bill can be transferred to her in case he leaves active duty before retirement. Definitely something to look into.

Any tips for college savings?

What’s something you wish you would have done sooner, or thought you would “never” do?

GI Bill benefits CAN be transferred to spouses or children!!! My parents started a 529 fund for our little one already and we’ll put baptism/birthday money plus our own money into it. I can’t imagine how expensive college will be by the time this little one runs off to college.

Haha I would live to hear that scream…. Nothing is cuter than listening to a baby chatting away to themselves!

Meant to write “love”. Darn autocorrect!

Yep – GI benefits can be transferred to any child that is already born (our problem…baby is still in utero). When you transfer bennies, though, sometimes you incur additional time onto your service obligation depending on the particular situation so have Tom look into that. Even though Patrick had done the 8 year aviation commitment (so 10 total), he was going to have to add another tour to give the GI Bill to the baby or something. I don’t know the details…but it didn’t work out for us.

It’s fantastic that you’re already saving for her college fund…My parents never did that and didn’t help pay for a penny of my college–graduating with all of that debt royally sucks…You’re definitely doing the responsible thing!

http://www.gibill.va.gov/benefits/post_911_gibill/transfer_of_benefits.html

Check out that website for transfer eligibility

I let my baby (6 weeks old) co-sleep with me but only when I REALLY need sleep. He just sleeps so good beside me. I pull the covers away from him and we snooze away. I love it. It only happens a few times a week and never at night. I don’t want him getting too comfy in our bed at bedtime.

I also didn’t want to use a pacifier but he started sucking his hand. I don’t want him to be a thumb sucker if I can help it. I can take away a pacifier; I can’t take his thumb away. Luckily, he’s not attached to it. He doesn’t sleep with it. He mostly takes it during a “traumatizing” event, like tummy time or getting put in the carseat. He wants it for a minute or two and he’s good.

I totally agree about wishing I discovered the side nurse position earlier…I knew people did it, but now at 6 months it has become out new staple position in the middle of the night and first thing in the morning. She actually concentrates a lot more and I can still snooze a little bit.

For college savings (outside of GI bill), check out http://www.collegesavings.org . Various states have 529 plans. Nevada, Utah and Alaska have well rated ones. We are looking at Nevada or Utah as they both consist of very low-fee and good Vanguard funds. BUT, you might also want to consider the tax break you get from investing in one of the AZ plans since you are a resident. What we do is invest enough each year in state plan to get the tax break, then the rest in another state’s plan.

Good luck with the cloth diapers! Can’t wait to hear how it goes. I think that’s so awesome you started a college fund even before you knew Liv was on the way!

I love these posts. I don’t know about if gets out before his 20 but if he does retire it can be transferred. We just had an enlisted friend do that for his daughter. The fact you guys are already so aware and making such an effort you have nothing to worry about I’m sure 🙂 now I’m reading the other comments and see other people already answered lol I gotta say though I always hear it can be transferred to a spouse. Good luck trying to actually do it we have 2 friends getting no where. I don’t know that either my husband or myself will go to retirement but this post made me stop and think more about the benefits of it. We’re getting ready to start trying to have a baby in about a month or so. Thank you for all the tips! 🙂

Yes, it’s really easy to transfer to a child. You have to have served 6 years and then you incur another 4.

that’s really good to know about the carrier thing…wes is only 5 weeks old but he LOVES the moby and that’s definitely something that might make the store an easier excursion for us during the day!

Live is so cute in that cart, adorable!

That sleeping pic is SO sweet! Sleeping babies are the cutest!!!

Ginaaaaaa! That sleeping picture with her mouth open just kills me. She really is something and I’m not one to overly gush over babies. Thank you SO much for letting us have a glimpse into your cart. If it is possible to do this more in the future, I would love it. It really does help to see the staples you buy and how you shop. Please share more! 🙂

thank you- she’s an angel baby 🙂

i’m going to do a post on that for the am!

xoxo

College saving can be a good learning experience for your little one! Having just graduated university debt free (WAHOO!), this is my advice: as soon as my parents first started throwing birthday parties for me, or during holidays.. my parents would do the 30-30-30 rule… one third to charity (or I could donate some toys etc I wasn’t using), one third saving, and one third my own. It is especially effective if you put the “saving third” into an education specific account.. the moolah adds up quickly! 🙂

If you transfer at least a month over to her or you, that kicks a lot of things into gear. In case anything every happens to the active duty member it solidifies that either of you can use the GI Bill. It depends on how much time you transfer, and how much of a commitment they have left.

Trevor transferred 18 months to me and incurred 1 month, because he still has 3.5 years left. So if Tom still has a few years in its probably a great option. Plus anytime that you can use some of his GI Bill obviously helps college costs…even a little bit counts!

Saving for College (university) is something that nobody here does, because university used to be free and nobody has gotten used to the fact that it isn’t yet! However, I think it’s going to catch on as people realise that student debt is out of control. I’m lucky to only owe $15,000 and that’s because I saved for my own education and only incurred debt in the last two years of it. I’m not sure what US College debt is like, but it’s not unusual to come out of an undergraduate degree with a $30,000 loan. It would be far more for an advanced degree.

My 7 months old baby girl went through the same “screaming” phase. We called her a little wildcat 🙂

I have money drafted on the first of the month, every month, and put into an account for Skylar for her college fund. It’s amazing in five years, even a fairly modest amount, what it’s turned into, which is nice to watch. I may need to drain the account sooner rather than later…kindergarten tuition here is more than I paid to go to college. Not even kidding.

that’s the preschool we want to send liv to! i was like, are you kidding me?!

Have you already prepped her diapers? If not, only washing them once isn’t going to be enough. You will need to wash them quite a few times the first go, otherwise they will leak and not be absorbent.

I washed them 5 times tonight w rock n green- do u think that’s good, or do I need to do more?

What kind of inserts do you have? You can check if they are prepped by taking a medicine dropper (or something similar) full of water and letting a few drops on the inserts. If the water absorbs right away, they are ready. If the water beads up a little, you’ll have to wash them more and if that’s the case, I would give the inserts a good long soak in the hottest water setting (like overnight) then finish the wash and do a double rinse. They should be good after that. THe covers should be fine after one wash though.

whoa, good to know! i’ll try that before i use them! i washed them 4x last night, so hopefully we’re good to go

I would do more washing e!! I had some leakage issues until I got to about 10 washes. Keep that in mind!! 🙂

good to know- no leaks yet, though!

I just looked into the gi bill since I’m going back to school but we wanted to save it for our kids. My enrollement officer said As long as he has been in 10 years it can be transferred to your kids. And if he’s not active duty at the time you use it they give you bah also!

amazing!!!

We haven’t reached the melt down stage in the grocery store or Target – hopefully it will never arrive! Little one loves riding around in the cart and looking at everything. It’s a great distraction for us both, and often we just go out of boredom. Funny how much you can spend at Target when you don’t need anything.

Wish I would have gotten out and about more often in the beginning. With all the pumping and supplementing, I rarely left the house those first few weeks, but we’re making up for it now. 🙂

that’s good to know- hopefully we won’t either! usually liv is absolutely perfect when we’re out and about and saves the shrieking for when we get back to the car 😉

i wish that, too. after not being home at all, to being stuck here for 3 weeks straight feeding and pumping.. i was pretty miserable. any day we get out of the house just to run an errand is always a little bit more fun.

hope you’re feeling well, friend!

xoxo

It is soooo much nicer to wear the baby on outings! It took us a while to realize this at first also! I love the snoozing picture, how adorable! THis will be our third and we’ve never successfully co-slept but I’m really excited about hopefully getting it right this time around! I looooove your wetbag! So cute! I mostly have neutral ones because I wasn’t sure if it would go in the boy’s room or the girl’s but the one I have for my diaper bag has pink all over it! 🙂 Hope you love Rockin Green, it’s definitely our favorite! DOn’t forget…..it’s not all or nothin’ with cloth! You can start as slow as you need. We just used cloth at home first. When I was ready to use cloth diapers on outings, I started with the ones that were less than 2 hours and close to the house. Just like having a new baby, you have to get all the kinks worked out and the logistics of diaper changes down. At first, you may have some leaky issues just because you’ll have to play with how much stuffing or how to adjust the diaper but just try to have fun with it and remember, there’s no rush! I promise you’ll love them once the new-ness of the shift is over! I would never have imagined we would use cloth at all but now we use it full time (even at night) on 2 kids! Seriously, never thought it would happen but we love it now! So funny about TOm’s reaction though, at first my husband was a little leary of the poop and I was the one who always washed the poopy diapers but now, he’s seen so much poop in so many different places, he doesn’t care. Actually, when I am nauseated, he’s the one that rinses most of the pooped diapers…….now THAT is love! 😉

You can also clip an infant car seat in the front basket of any standard grocery cart. Just flip down the advertisement if there is one, or get a cart without one and there is a groove on the bottom of the carseat that snaps into the basket. My directions suck, but I swear it works, I’ve done it at Trader Joes, Babies R Us, and two other regular grocery stores. I stalked a couple that had their baby locked in this way so that they could show me how to do it! 🙂

my has a different base (the orbit) so it doesn’t clip into anything :/

Good luck with cloth diapers! I could never do it, I am a mom who thrives on modern conveniences 🙂

Have you looked into Upromise at all? I signed up for it for myself after I graduated college to help me pay for my student loans, but you can also set it up for a baby and have the money automatically deposit into a 529 savings account. It’s one of those deals where you get a certain percentage back for normal purchases you make anyway. So far I’ve earned $730 in just a couple of years that was deposited directly onto my loans. I can imagine if you started on this kind of thing so many years early that the savings would make a significant dent.

amazing- i had no idea about that!

thank you

Yes! My sister did that too and had the kidless aunts & uncles plus grandparents register our credit cards too so it really piled up.

Good luck with the cloth diaper trial! We’re going to start from the beginning, so we’re not so tempted to throw in the towel. Just one tip though: I’ve heard that you need to wash them (to “strip” them, I think) 4-5 times before you start using them, otherwise they won’t be very absorbent. I’ve heard stories of moms starting cloth diapering without doing this, and they automatically hate it b/c they experience leaking right away. If you haven’t checked out the blogs All about Cloth Diapers and Padded Tush Stats (which gives awesome laundering info), you should. Good luck!

good to know! i washed them 4 times last night and am starting today when liv wakes up from her nap… ahhhhhhhh

that’s hilarious! “you have fun with that” lol…Livi is such a beautiful little baby and it is so amazing to watch you and your family grow and to hear about all your stories, from when you started the blog to know. you are a true inspiration to so many people and I constantly recommend your blog to my friends as a source of hilarious comments, stories, fantastic workout and cooking tips. thank you so much, as always, for sharing your great sense of humor, wonderful advice and pics of the little cutie pie growing like a little weed!

thank you so much for reading, christina and for the kind words!

xoxo

My parents did a 529 plan for me and it definitely was something they say they are SO glad they did. I know there are diff plans though and I don’t know much about the specifics so I’m sorry I’m not too much help!

I have to admit that I don’t know if I’d ever consider using cloth diapers. Props to you for taking that on!

Just wait til Olivia is old enough to ride in the cart 🙂 I LOVED it, in fact my mom had to finally make me stop because I got too big and was in denial about it.

i’m excited for those days 🙂

It’s amazing how that little extra sleep in the morning will help so much!! And I love first morning snuggles! Also I wouldn’t be able to survive trips to the store without my Moby! Lol! Especially when you start having more than one. After I have this one in July, I will have one sitting in the little part of the cart, one in the big part and one in the Moby. It should be interesting! Lol!

amazing!!

-nothing more delicious than sleeping w/ bebe in the morning!!!

-i just saw younghouselove post on cloth dipes – wow – very motivating! here’s link:

http://www.younghouselove.com/2010/08/the-much-requested-cloth-diaper-post/

Depending on where you’re living and where Livi wants to go to school, a lot of public universities have really good deals on tuition. Louisiana has a program called TOPS, where regardless of how much money your family makes, if you make over a 3.2 and get a certain ACT score you get 75% of your tuition paid (don’t quote me on exact statistics. I know Florida does something similar as well. It just makes paying for college a LOT LOT easier and less scary.

az has that, too- it’s awesome! i got a full ride + books paid for, just for having a certain gpa. i’m wondering where we’ll live when she goes to college, though. that makes things a little tricky

Haha, hopefully somewhere that has a program like that! It is good you’re saving just in case, but wouldn’t it be awesome if Livi went to a school like that?!

I wonder if you can retain (assuming you have it now) AZ residency, regardless of where you live? I think that’s an option for military, isn’t it?

That’s one reason I didn’t pick a 529… my daughter will probably get a state full ride due to her grades. My sister made her kids a deal that they could get a new car out of their college fund money if they got full ride scholarships, and they did. Seemed like a fair deal! A 529 won’t let you buy a car, though (without penalties).

Oh duh, you probably meant what if she wants to go to college out of AZ because you live out of AZ.

that is a SWEET deal. maybe we’ll do something similar, because both of our parents told us we had to get scholarships if we wanted to go to college, and we both did 😉

The 529 is a cool deal but if you don’t need that money for tuition (due to scholarships, GI bill, opting out of college, etc.), you pay taxes on it like any other account, plus a 10% penalty. But you can just keep the money in it and roll it to other kids, even Livi’s kids someday! Or to yourself, or grad school for her… lots of options.

I’ve got my daughter’s college fund in a Uniform Gift to Minors Account. It’s fully taxable but we can use it for anything without penalty. A downside for some parents is she owns it when she hits adulthood, so she could theoretically use it all on drugs or a Harley or something. I think a 529 stays ‘owned’ by the parent(s), so you have that control.

There are also pre-paid tuition plans and Coverdell ESA’s. I just went through this. Can you tell?

thank you so much for all of the tips!

I haven’t seen it here yet so I just have to say to all please please do not forgo savings for your own future (when you can no longer work) to only save for college! My parents have many friends who are in a world of hurt because they paid for kids’ college at the expense of their future. Medicare & social security will either be long gone or much reduced by then.

We know people who have had to make serious trade offs just to afford a surgery even with Medicare. There is no financing for retirement but ways to help pay off student loans if you can. Twenties & early thirties is the power time to save big and let it sit and grow if possible. I know this seems like a far off concern but that’s why so many get stuck.

Ok – I’m done. Hopefully good food for thought. 🙂

yep, our savings are always #1- we’ve had a few accounts for a couple of years that we regularly deposit into.

its the oxygen mask kinda thing: you have to look out for #1 first

ahhh look at her! such a cutie!

529s are great because the money grows tax free! We really tried to push to put as much as we could in early on because the money has so much time to grow and double and tripple. Otherwise we contribure once or twice a year. The year we skipped a summer beach trip (terrible 2s) we put the money that we would have spent into the 529. You may want to see if your local grocery store has a program called something like Upromise. They will contribute a small portion of the profit from your shopping to the 529. You can even have family members shopping for the 529.

I don’t have kids, but I am a college student, so I know what was great. First, for the next year or so, when people want to give you/her a gift, ask for savings bonds. They were an absolutely lifesaver! And, Liv is not going to remember if someone gave her a giant teddy bear.

Also, I’m not sure what the fund is called, but there’s an education specific savings account that parents can set up. Absolutely do that! It ensures that all the money you’ve saved will go for Liv’s education, so she can’t spend it on something frivolous and it will encourage her to get as much education as possible since the money will go to waste if she doesn’t.

And finally, keep your credit score as high as possible. If she has to get student loans, a lot of it will depend on her co-signer, which will probably be you.