Breaking in the new budget

Hiiiiii 😀 Happy Monday to ya. Hope your morning is going well!

After I last *saw* you last night, we went over to the madre’s for my stepdad’s bday dinner.

My contribution to the feast:

Mashed sweet potatoes 🙂

I just baked about 12 organic sweet potatoes at 375* for an hour and 15 minutes, peeled, tossed them in batches into the stand mixer and added Earth Balance, sea salt, pepper, and a hefty drizzle of maple syrup. So easy, so good.

At madre’s, I munched on Chipotle-lime shrimp with my sweet potatoes, and the fam also dined on grilled ribs, corn, and of course there was cake:

Madre made that creation with Oreo crust, topped with a layer of fudge, caramel, then butter pecan ice cream, Cool Whip and Oreo crumbles. I had a few bites 🙂

Since we’re still waiting for our new mattress to get here, we had a camp out last night with our other mattresses on the floor (Bella loved it) and then I made some bfast:

Chocolate cherry smoothie and a piece of brown rice toast with AB to munch after spin 😀

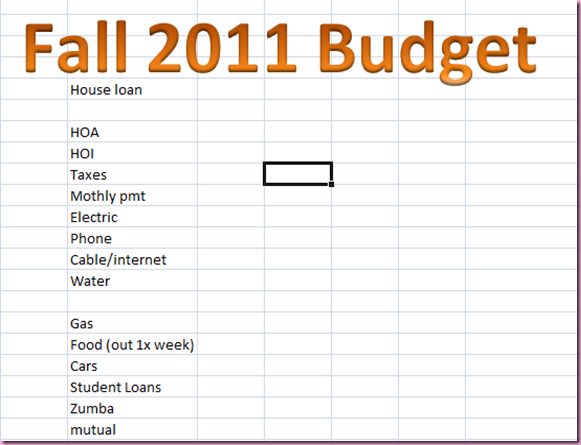

There’s a TON to do today, but the #1 thing I’m most [nerdily] excited about is tackling the new budget.

We moved into the house a couple of months ago and while we had a tentative budget, now we know exactly how much all of our bills are and when they’re due, so I can tweak our current spreadsheet to reflect the new numbers.

We still follow our usual method, but a couple of things have changed since the Pilot has been home:

-We have a weekly food amount we stick to (which includes one *nice* dinner out each week)

-We have an allowance. This is the money we each spend on *extra* things each week. Usually for me, it’s shopping or spa services, and for the Pilot it’s grabbing lunch when we don’t pack him one or other random things.

Here’s a post I did on *budgeting* if you’d like more info – it’s a great fall goal and another way to start fresh 🙂

Do you follow a budget, or follow “go with the flow and be mindful of spending” type of approach?

Off to spin!

xoxo

Gina

Something to read:

–The fall (please send my friend Ash some love and healing vibes!)

We recently redid our budget and I actually love seeing what we spend and where it all goes. Right now we are using mint.com to track… at first I was very impressed, now, eh, it’s ok.

Love budgeting though 🙂

i was really excited to use mint, but they don’t have one of my banks in their system, so it wasn’t as helpful as i hoped it would be :/

I’ve got to tackle our budget today too. I tweaked it over the summer when I wasn’t teaching as many classes but now that things are back in full swing this week it’s time to go over it again. I too am nerdily excited about it. I guess that’s what comes of finance majors when they don’t use their degrees 😉

haha amen to that!

I have 2 kids, one akita, my husband, and I all living in NYC. We have a budget. A strict one.

I’ve tried setting a budget these last few months and it doesn’t work. Last month, I tried a different type of budget. I paid all of my bills (which are usually the same), put x automatically in savings, and then with x leftover, I can spend it how I choose. So if I don’t eat out, I have more to spend on clothes. This worked a lot better and I had some left over to add to my savings!

So I think its a fusion of the two? Hey, whatever works, right? 🙂

I am moderately obsessed with budgeting and using Excel. My friends have dubbed my the Excel queen due to the sheer number of spreadsheets I have (total budgets, project budgets, grad school plans, workout schedule,etc). 🙂

*dubbed me

my husband and i are really starting to get into budgeting. it’s a strange adjustment to make since we moved in and combined our incomes. we’re learning though! 🙂

The boyfriend and I are just starting to look for apartments after living apart at our parents houses since college to save money. Him=XBOX games, Me=Yoga…there will DEFINITELY need to be a budget. lol. Too bad we were both liberal arts majors and fear spreadsheets!

don’t fear spreadsheets- they’re surprisingly user-friendly. once you start, you’ll be hooked 😉

I’m not as organised as you – it’s all in my head! We’re not big spenders so even though we have a low income, we’ve never gotten into trouble.

We follow a budget but not to a T. Our most important thing (other then paying all the bills) is putting as much money as we can away every month. Some months are harder than others as we have more expenses but for the most part, we rock our budget! I’m addicted to seeing the savings account grow! : )

Gina, Thanks for the budgeting tips! I went back to read your older post about budgeting and was looking for the second part where you were going to talk about budgeting for food but could not find it. Did you do the second part of that post or am I just overlooking it?

By the way I suck at budgeting. I grew up in a very low-income family and money scares me in general. It scares me to have it and to be without out it. I find myself avoiding paying bills even if there is money in my account. It is very tough for me but I am working on it! Wishing I could get excited by an excel budget plan :/

here ya go: http://fitnessista.com/2011/01/shopping-smartly/

I love budget spreadsheets too! My fiance and I just moved in together and got a joint checking account so we had to create a budget together. We also each have a weekly “allowance.” We take out cash on Sunday and use that for misc spending like lunch out, or gum from the store, or manicures throughout the wee. It helps us stick to a budget, be mindful of how much we actually spend each week, and then neither of us (ok, me) is inspecting the bank account transactions to see where the other spends money. It kind of keeps the peace.

We are definitely budget people – it’s kind of gone out the window this month with the PCS but that’s what DITY money is for. HA. We have our weekly allowance too. I feel like I need to make a weekly allowance for the baby too – I mean she is going to need to be well dressed too 😉

we’re still waiting for our dity money… hopefully it will show up soon! and i totally agree- our baby already has an account 🙂

I’m definitely an anal budgeter. I feel so scared and out of control when I don’t plan to cover all of my bills, savings and expenses each month

We’re more of a go with the flow kind of household. Even though we don’t adhere to a strict budget, our expenses always tend to fall within the same ranges. Some months may be slighlty higher than others, some lower, but it all evens out in the end of the year. I keep one master budget to see “cash flow” and make sure our income is always exceeding our expenses but I update that only when something changes, not to follow on a monthly basis.

I wish I could be as organized as you are. We try to budget and have been getting better but nothing like you’re method. THat oreo cake looks so good btw.

I’m trying to be a budget person, as in, I record all my expenses in a spreadsheet and aim to stick to a set amount in each ‘category’ (food, clothes, household products, etc) each month. It’s hard, but I like to think I’m getting a bit better at it each month!

I’m definitely a budget person!

We do follow a budget and we do the same “allowance” thing — that way if Jason decides to blow his money on video games I can’t complain 🙂

We have all of our money combined and that works well for us — I can’t imagine figuring out who pays for what or paying a percentage, etc — that seems like a pain in the ass to me!

I’m trying those sweet potatoes ASAP. 🙂 Never thought of mashing potatoes using sweet ones—very fallish. I like it!

This post came at the most perfect time! I am considering some life changes that would require me to adhere to a tighter budget. I need to become more aware of how much I spend on groceries in addition to finding other ways to cut back.

*Just* re-ded budgets after consolidating student loans. Eeps! Also recently moved to the DC area which is painfully expensive, our rent more than doubled. West coast is the shiz. 🙂

I use Mint to track my finances, though I’d like to keep an spreadsheet too.

We just moved into a new apartment and that will dramatically change our budget. Also, with the fiance’s new job, our budget has more wiggle room, which is nice.

However, since I’m number-challenged, he is in charge of all things budget related and I just do what he tells me to do. (How very 1950’s of us!) Hey, it works out for me! 🙂

I think a budget is a really great idea to save money! I don’t need one yet, but I have a feeling if things get stressful I’ll turn to a spreadsheet. I do rely HEAVILY on an planner for a daily basis.

i’m horrible at budgeting. hence the bf is in-charge of the money sitch bc he’s so good at it. and as long as i get my allowance, it’s all good in the hood!

I love that you guys budget! We always have a strict one set up, and with some recent financial changes-hubby’s raise (yay!) and losing the renters in our home- we need to do a new one! IT actually stresses me out until it is all set in stone! Love to see that other couples do an “allowance” too. People always look at me so strange when I tell them we do this! I love saving up for something I really want and seeing hubs buy and do the things he wants too!

I love that you budget! I get geek-ily excited about all things finance and am having a blast in my investment class right now. I just decided last week to join the stock market club. I’m such a nerd. ;p Being a college student my budget is kind of spend as little money as possible, but I love to shop and eat out, so balancing that is kind of hard sometimes!

I’m a CPA so I am an excel spreadsheet fanatic when it comes to my budget! I can’t stand when I don’t have my bills organized and amounts set aside each week for food/extra/etc. – I feel so disorganized lol!

I love budgetting. I do it month by month and I get SO excited about it to which my husband shakes his head and doesn’t understand how I can love it so much.

I tried Mint but they didn’t have one of my credit cards in their system and so it wasn’t as great as I heard it was.

I’m getting married in 21 days (eek! so exciting!) and after dating for 5 years we are just now combining our income. I want to start it off right by making sure we have a record of our money from day one. The problem is I have no idea how to use excel to do that. We have debt from student loans and I’ve heard some people talk about mapping out all their debt so they know exactly when it will be paid off and they have all the records of everything in one place. Right now I just pay everything through online bill pay but I’d love to transfer all that information onto an excel sheet. I’m going to re-read all your budget advice when I get home from work and try to learn a thing or two.

Those sweet potatoes look yummy (makes me excited to give my little bebe his first taste of some this week)! Yea for budgeting! I always feel so much better after it’s done (but the before sucks!)

Smoking Crayolas Blogspot

I’m somewhat on a budget, but haven’t been following it to a T. I’m trying to pay off credit cards, build up my personal savings and throw in moolah in our joint account for a down payment for a house. So far, I’ve been okay, though my biggest vice is buying loads of food from the store. Lol. Nothing like fresh foods 🙂

I pretty much go with the flow and try to save where I can. For instance, I rarely buy coffee when I’m out. A thermos holds even more and it’s free!

we do a budget and it is rough. even though I’m not the breadwinner anymore (thank God! hubbs got a job!) it is tough having money for everything. but it is amazing to know where the money goes and to control it, and not be controlled by it. so now we try to save for a house…

question: how does one make almond butter? I tried to make it the other day in my friend’s vitamix and mine ended up more like ‘almond crumbs’ even though we added coconut oil, it was still so dry!!

I applaud you for having a budget at your age. Not many young couple have the foresight or discipline to deal with a budget. We have been married 25 years and have lived on a budget every year. We have also always done the “allowance” giving to ourselves. It has worked all these year. We are putting 2 kids through college right now without any loans so we feel very succeful with our budget. Good Luck on your future. You will never regret living within your means!!

I wanted to comment on this because I first of all think it’s amazing that you are putting two kids through college loan-free (my parents did the same and I will forever be grateful for that), and I want to agree that living within your means is an amazing feeling without any regret. How can you regret not racking up credit card debt? 🙂

I try to stick to a budget but I am awful at keeping up with my spreadsheet. I love creating it ( my uber nerdy enginneer coming out) but I hate maintaining it and entering numbers from month to month. I’m getting better little by little.

Hey lady, those potatoes look lovely. I am on a tight cash budget! At the beginning of the month I move the money for bills and what not out of my savings into my checking account, take out what I will need for food and for extras, and then THAT’S IT! Every thing else stays in savings, and all paychecks go into savings. Done and done. I find a cash diet really helps reign in all extra spending, because you have a tangible knowledge of exactly what you have spent. And when it is gone, party is over.

This post couldn’t have come at a more perfect time as creating a new budget has been on my mind all weekend! 🙂 I feel like the beginning of fall is a great time to create a new or revamp an existing budget, especially with the upcoming holidays.

I’m definitely a budget person, but I hate spreadsheets so I just use my email calendar to help me remember when certain bills are due. Then I take out a certain amount in cash that I use for the two weeks before my next paycheck, and the rest goes into savings. 🙂 Numbers aren’t really my thang, so finding a simple way to manage my money was key to me and that includes using only cash to purchase items. If I want a massage or need to change the oil in my car, I usually try to cut back each week and save a $20 bill here and there until I have enough to do those things. 🙂

We’re on a “go with the flow” budget right now. Which is good…because I think sitting down and actually figuring out where some of our money disappears to would scare the s*&t out of me right now. And that probably means that we should actually do it! 🙂

Ohh those mashed sweet potatoes look delicious!! I’m still new to the whole sweet potato thing but I might have to make those! And yum, that cake sounds fabulous that the madre made!! I doubt I would have been able to stop after a few bites though! Thanks for the budget info, I’m def going to read your other post! I have been trying to figure out budgeting for a while so I can use all the help I can get!

We followed Dave Ramsey’s plan to become debt free so we’ve been on a budget for years. We are also self employed so we have to be extra careful as there is never a guaranteed paycheck the next month. So we are definitely budgeters! I take care of almost all of it.

I think the thing that has helped us the most is every Monday I give Dh & I both spending money. Dh gets more because he ends up paying for stuff if we go out, etc., but it’s money we can spend on whatever we want and it’s very freeing!

I’m definately a budget/excel nerd, but my personal budget has taken a back seat lately to all of the various grant budgets I manage at work. I’m currently fixing up my personal budget right now, so your post was very helpful to read. I’m currently giving the ‘Pear Budget’ excel form a go to see how it works out. So far, so good!

i really need to work out a budget, mostly for grocery shopping, its so easy to spend too much!

we don’t have a budget at all. we buy such good (organic, etc) food and like wine and good beer – that stuff costs a fortune but we consider it worth it for health and happiness. I do try to curb spending on fun stuff when I know we have a huge expense (like having to buy plane tickets for Thanksgiving) coming up. it’s all very informal though.

part of the reason we can get away with this is living within our means. we only have one child, we only have one (relatively small) car payment, etc. these are conscious choices that make us not have to watch our pocketbook much. that’s lower-stress to me…….. seeing all the $$ we spend on everything would stress me out 🙂

mmm mashed sweet potatoes and maple syrup = YUM! 🙂

I really need to be like you and create a nice little spreadsheet for budgeting. Aside from my mortgage, I think I spend the most on groceries each month. The problem is, I’m so picky about buying the highest quality ingredients and can NOT stick to a list when I grocery shop. This is why my pantry and fridge are always packed with too many awesome foods to eat. I justify it because I don’t go and spend a bunch of money on shoes or clothing too often (well, unless it’s cute workout clothing….).

I tried just taking $200 out of each paycheck (I get paid twice a month) and using only that for groceries. I think I lasted a week and a half, if that. I blame it all on Whole Foods!

We don’t have a budget with everything itemized out – but I am aware of my “cushion” and make a point to keep it stable or growing. We also have separate checking accts. so he pays half the bills and I pay the other half. I keep our nest egg going and we use his extra for fun things. He gets paid on commission and is not good at saving during the “high” times in preparation for the “low” times. Money really burns a hole in his pocket, but I’ve been working on him! Take care you guys.

I don’t follow a budget per se but I try to spend as little as possible on the day to day stuff, i.e. not going out for Starbucks and making coffee at home; not buying granola/snack bars and making my own, buying thrift store cute dishes to take bloggie pics on for $1 each than $10 each new at other stores, etc.

That way when I do want to splurge, I don’t really think as much about it. Or stress over it as much 🙂

love the link to 10 Foods, 40 recipes! 🙂

I was so sorry to read about your friend Ashley. The line that struck me was “I didn’t have any identification on me…” I often go out for long (20-30 mile) bike rides on my own. I also run, sometimes on wilderness trails, and I’ve often worried about something happening to me (a number of years ago, a friend of mine was struck by a car while cycling on a rural road and the driver left the scene–she had a broken back and nearly died). I don’t like to carry a phone (too big), so I’ve started wearing a Road ID. I now recommend them to all my outdoorsy friends. It might be worth mentioning to your readers (it’s also a family company and I think they do a lot of good).

I hope your friend heals quickly.